Introduction

The neverhpfilter package consists of 2

functions, 12 FRED economic data sets, Robert Shiller’s

U.S. Stock Market and CAPE Ratio data from 1871 through 2023, and a

data.frame containing the original filter estimates found

on table 2 of Hamilton

(2017) <doi:10.3386/w23429>. All data objects are stored as

.Rdata files in eXtensible Time Series (xts)

format.

One of the first things to know about the neverhpfilter

package is that it’s functions accept and output, xts

objects.

An xts object is a list consisting of a

vector index of some date/time class paired with a

matrix object containing data of type numeric.

data.table is also heavily used in finance and has

efficient date/time indexing capabilities as well. It is useful when

working with large data.frame like lists containing vectors of multiple

data types of equal length. If using data.table or some

other index based time series data object, merging the xts

objects created by functions of this package should be fairly easy. Note

xts is a dependency listed under the “Suggests” field of

data.table DESCRIPTION file.

For more information on xts objects, go here and here.

yth_glm

The yth_glm function wraps glm and

primarily exists to model the output for the yth_filter. On

that note, the function API allows one to use the ... to

pass any additional arguments to glm.

The yth_filter returns an object of class

glm, so one can use all generic methods associated with

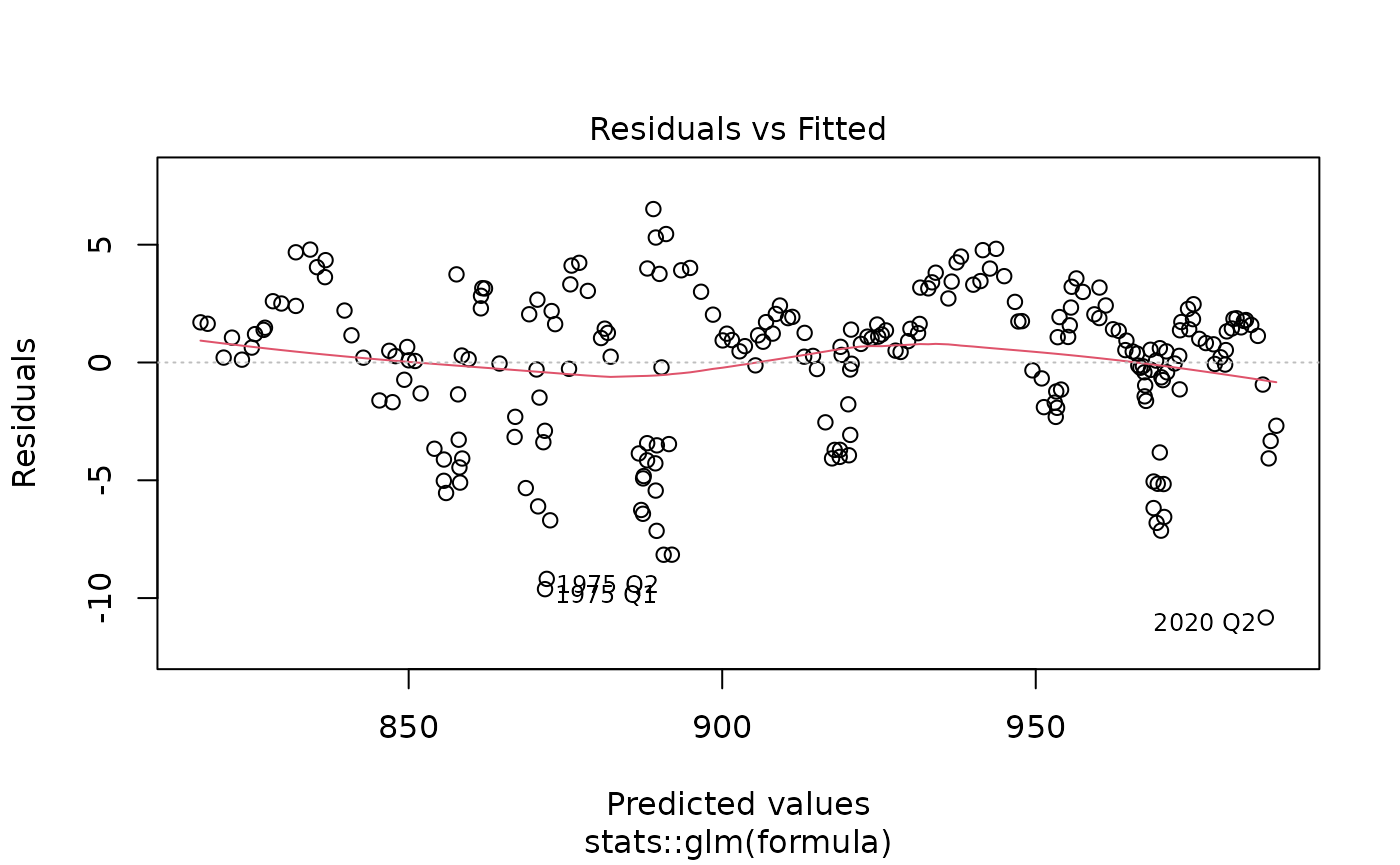

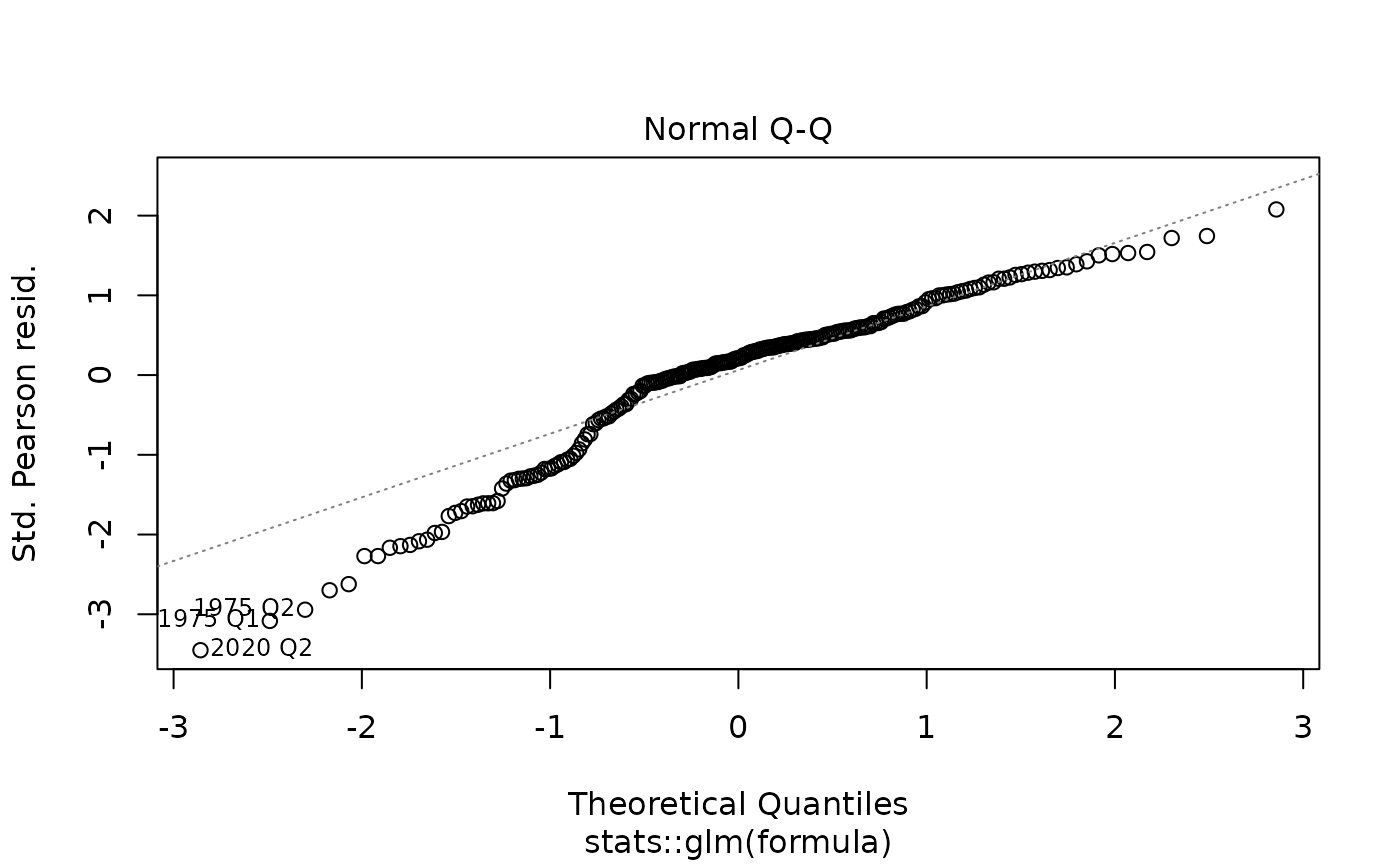

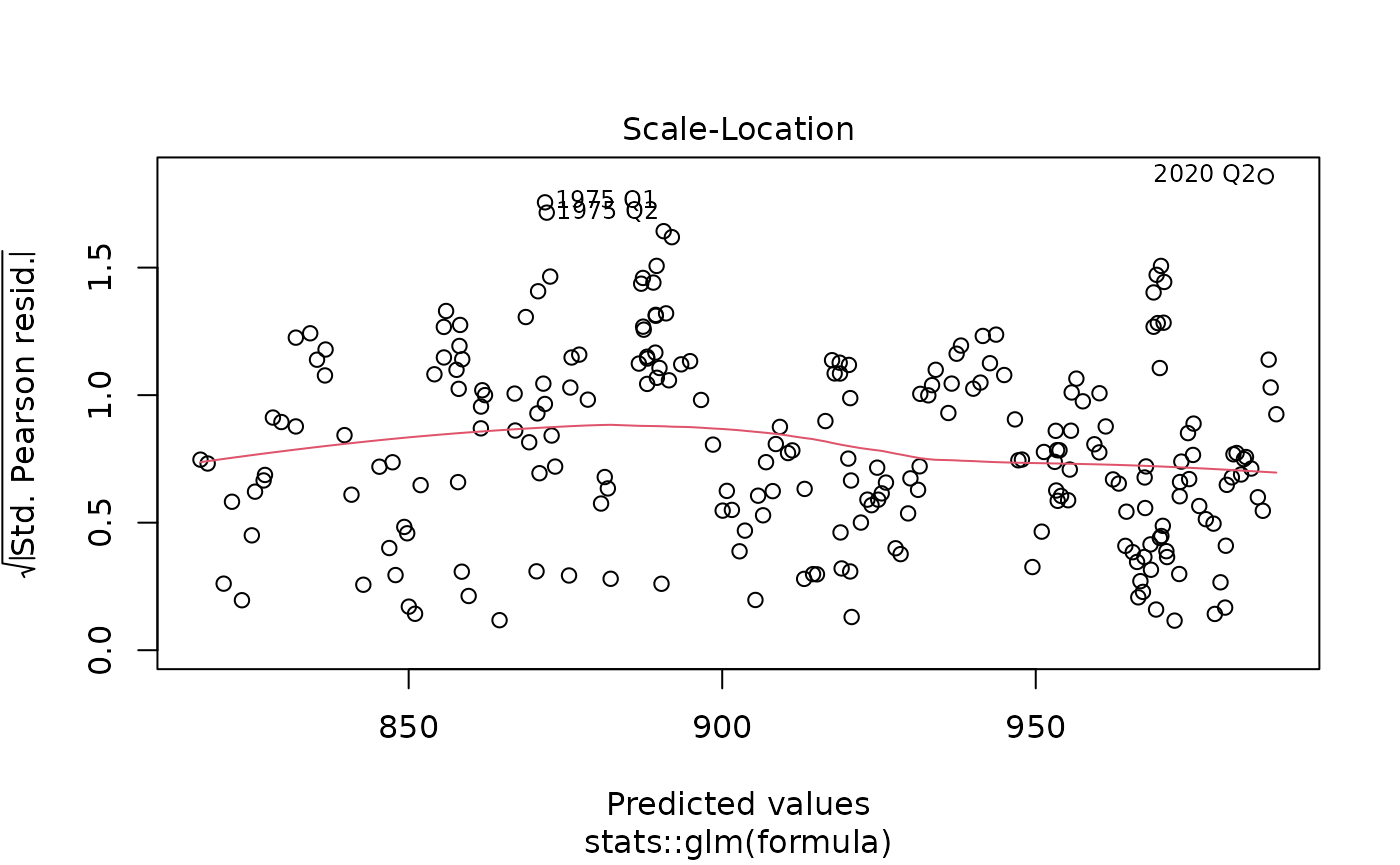

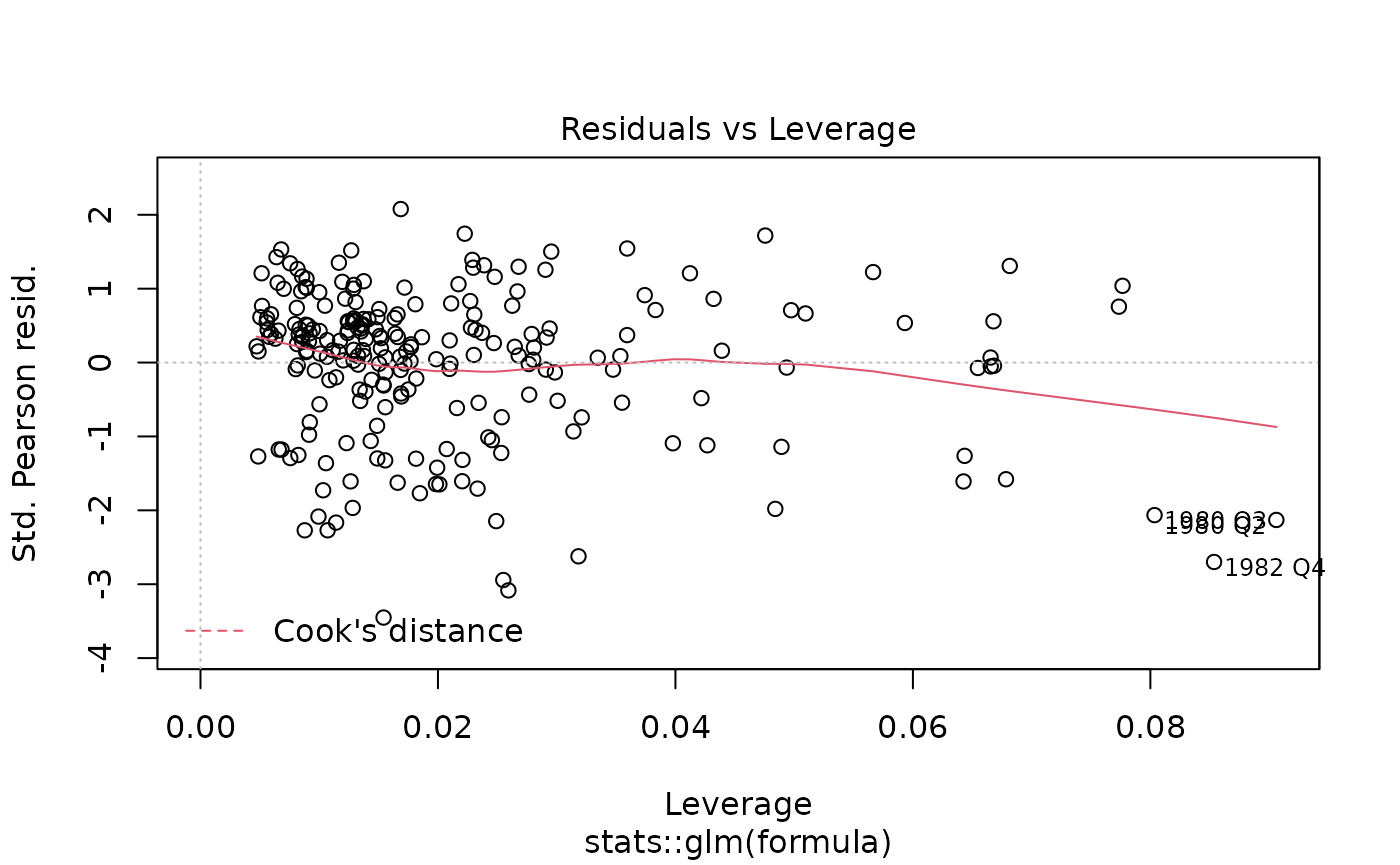

glm objects. Here is an example of passing the results of a

yth_glm model to the plot function, which

outputs the standard plot diagnostics associated with the method.

library(neverhpfilter)

data(GDPC1)

log_RGDP <- 100*log(GDPC1)

gdp_model <- yth_glm(log_RGDP["1960/"], h = 8, p = 4)

plot(gdp_model)

yth_filtered

This is the main function of the package. It both accepts and outputs

xts objects. The resulting output contains various series

discussed in Hamilton (2017). These are a user defined combination of

the original, trend, cycle, and random walk series. See documentation

and the original paper for further details.

gdp_filtered <- yth_filter(log_RGDP, h = 8, p = 4)

tail(gdp_filtered, 16)## GDPC1 GDPC1.trend GDPC1.cycle GDPC1.random

## 2021-07-01 997.9125 998.6146 -0.7021626 3.433573

## 2021-10-01 999.6996 999.2250 0.4745744 4.541104

## 2022-01-01 999.4418 998.0482 1.3935290 5.685544

## 2022-04-01 999.5119 991.0471 8.4648676 13.994958

## 2022-07-01 1000.1829 998.5432 1.6396952 7.127129

## 2022-10-01 1001.0073 999.1247 1.8825844 6.872664

## 2023-01-01 1001.6970 998.0610 3.6359814 6.191576

## 2023-04-01 1002.3021 1000.9223 1.3797813 5.238868

## 2023-07-01 1003.3679 1001.7246 1.6432798 5.455458

## 2023-10-01 1004.1535 1003.4622 0.6913126 4.453942

## 2024-01-01 1004.5575 1003.3985 1.1590058 5.115713

## 2024-04-01 1005.2937 1003.5638 1.7299355 5.781821

## 2024-07-01 1006.0504 1004.5563 1.4941034 5.867509

## 2024-10-01 1006.6556 1005.1812 1.4743859 5.648319

## 2025-01-01 1006.5297 1005.7135 0.8161385 4.832713

## 2025-04-01 1007.2609 1006.3020 0.9589198 4.958837

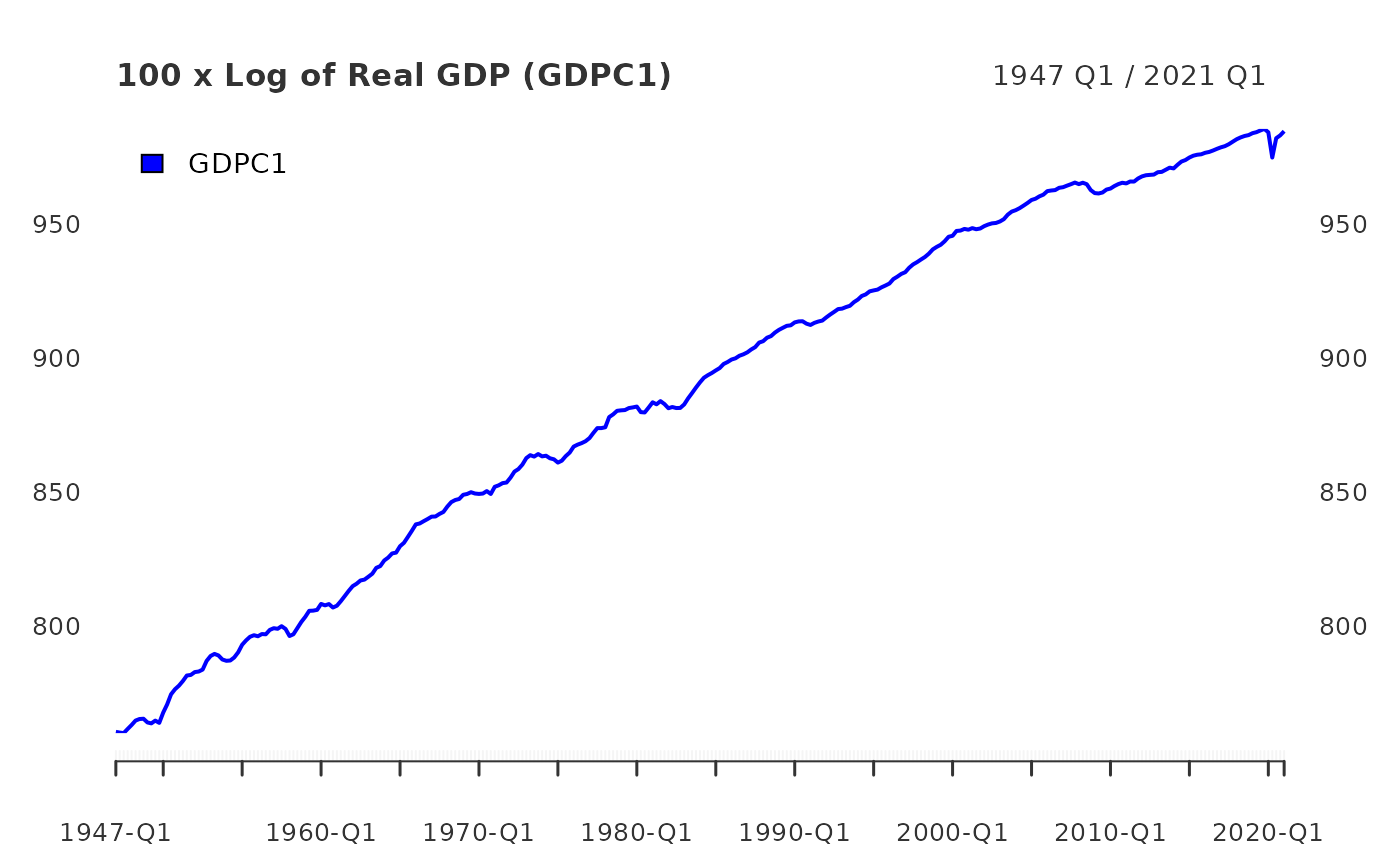

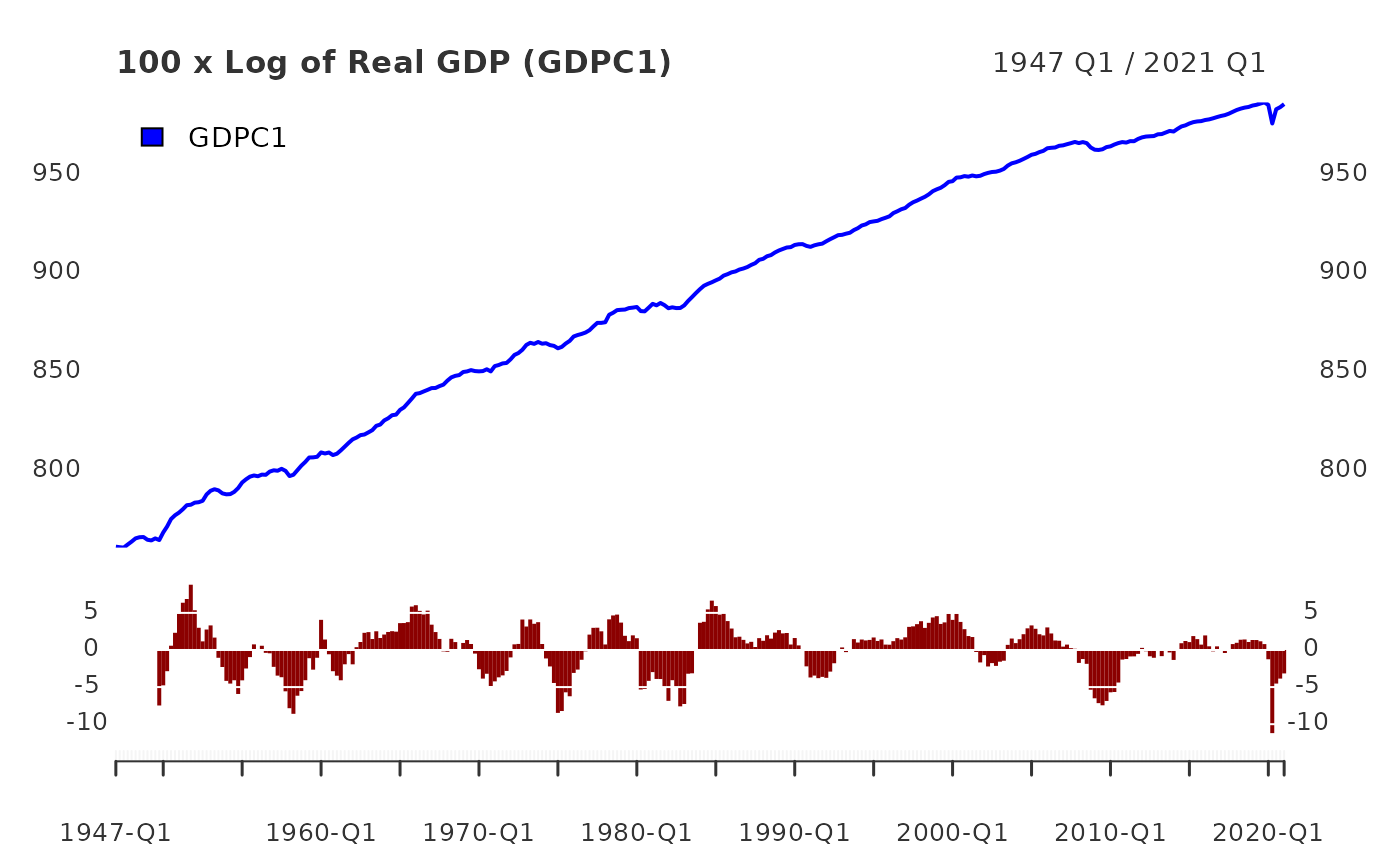

class(gdp_filtered)## [1] "xts" "zoo"As the output is an xts object, it inherits all generic

methods associated with xts. For example, one can

conveniently produce clean time series graphics with

plot.xts.

Note the use of xts::addPanel function, which is used to

panel plot the cycle component of the

yth_filter.

plot(log_RGDP, grid.col = "white", col = "blue", legend.loc = "topleft", main = "100 x Log of Real GDP (GDPC1)")

Choices for h and p

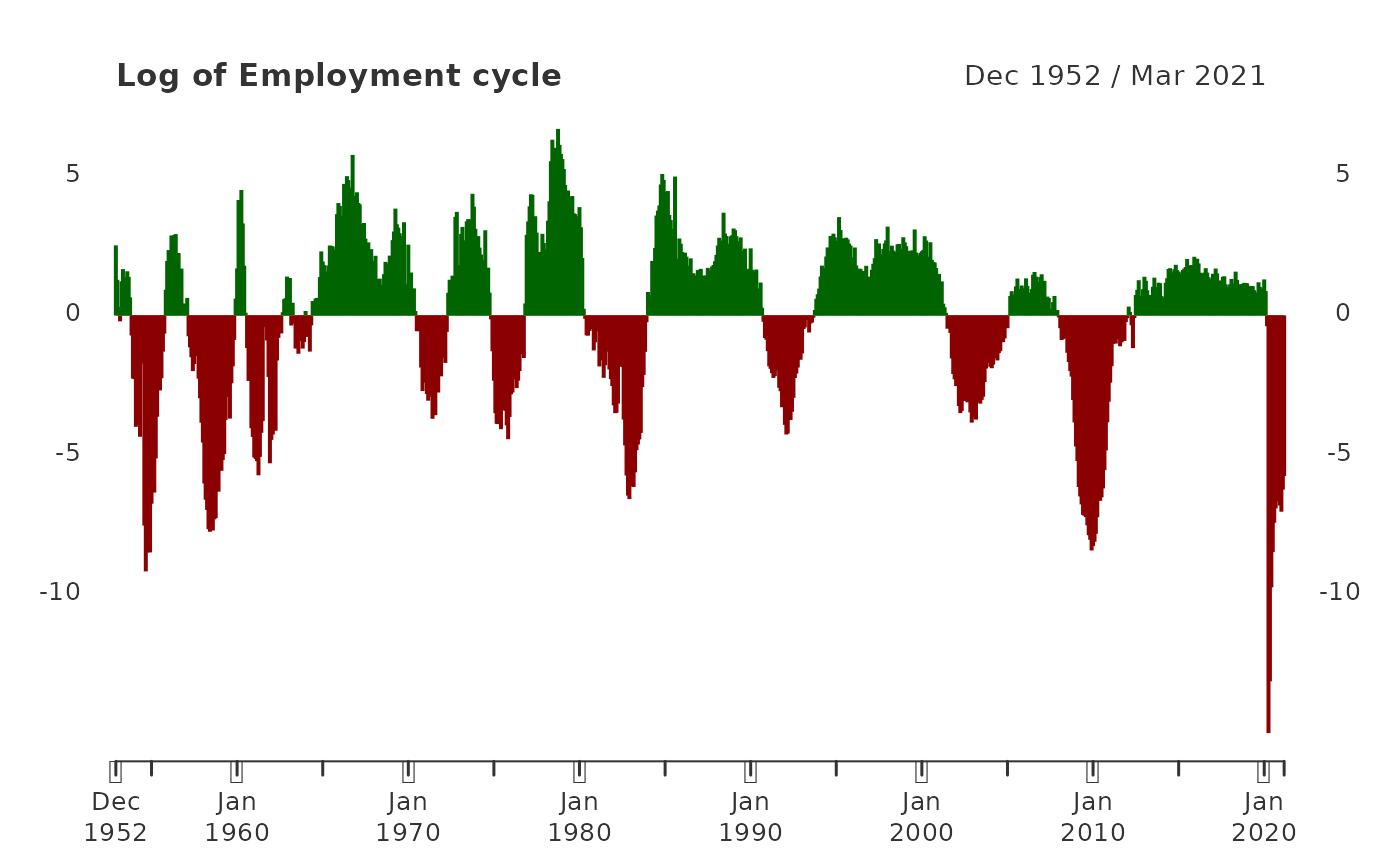

In the original paper, Hamilton aggregates the PAYEMS

monthly employment series into data of quarterly periodicity prior to

apply his filter. That is a desirable approach when comparing with other

economic series of quarterly periodicity. However, using the

yth_filter function, one can choose to retain the monthly

series and adjust the h and p parameters

accordingly.

The default parameters of h = 8 and p = 4

assume times series data of a quarterly periodicity. For time series of

monthly periodicity, one can retain the same look-ahead and lag periods

with h = 24 and p = 12. See the

yth_filter documentation for more details.

Employment_log <- 100*log(PAYEMS["1950/"])

employment_cycle <- yth_filter(Employment_log, h = 24, p = 12, output = "cycle")

plot(employment_cycle, grid.col = "white", type = "h", up.col = "darkgreen", dn.col = "darkred",

main = "Log of Employment cycle")

In addition to adjusting parameters to accommodate other

periodicities, one may wish to explore longer term cycles by extending

h. Below are examples of moving the look-ahead period

defined by h from 8 quarters (2 years), to 20 quarters (5

years), and then 40 quarters (10 years). These examples are not an

endorsement or suggestion of these parameters, merely an illustration of

the flexibility the function offers.

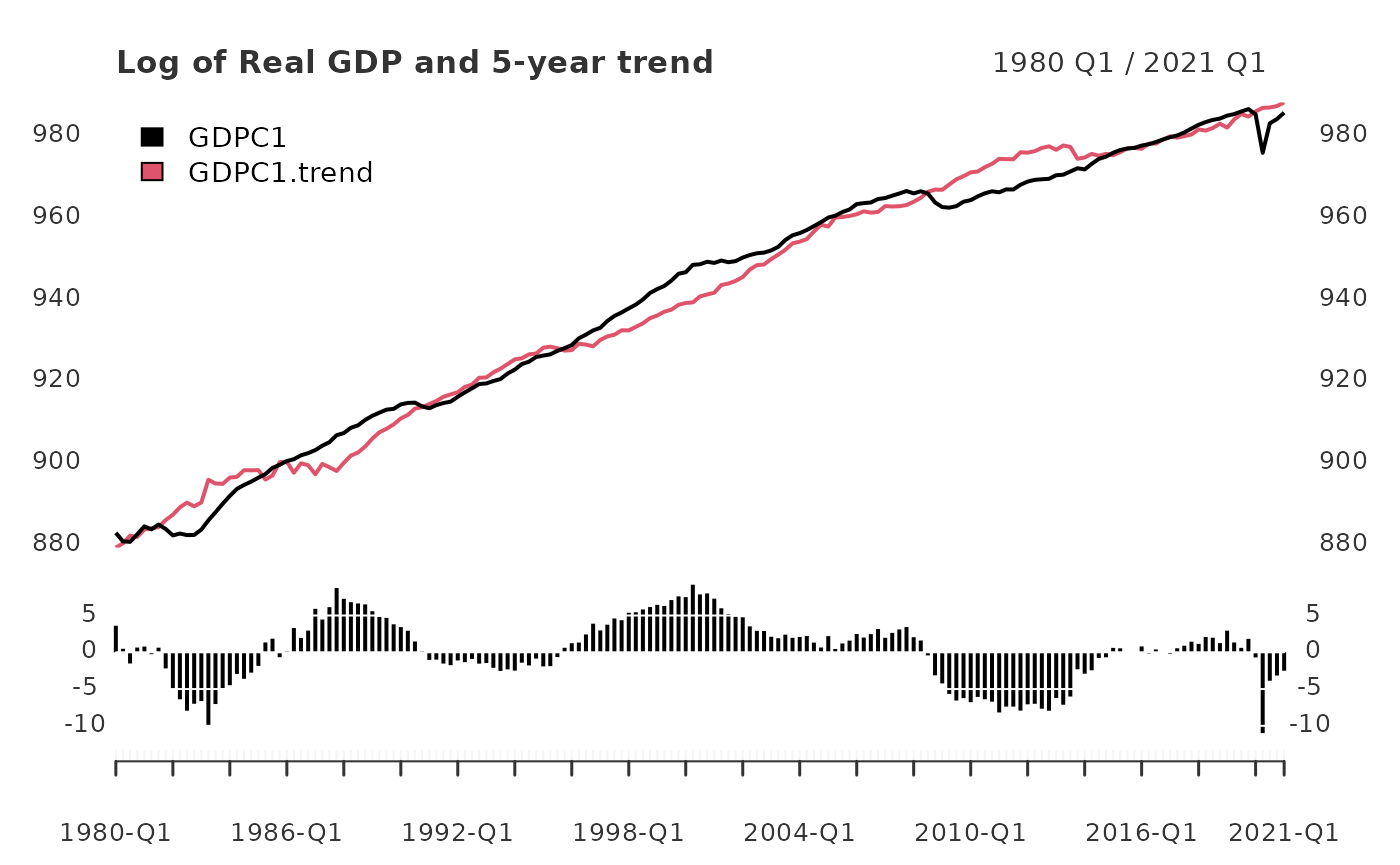

gdp_5yr <- yth_filter(log_RGDP, h = 20, p = 4, output = c("x", "trend", "cycle"))

plot(gdp_5yr["1980/"][,1:2], grid.col = "white", legend.loc = "topleft",

main = "Log of Real GDP and 5-year trend",

panels = 'lines(gdp_5yr["1980/"][,3], type="h", on=NA)')

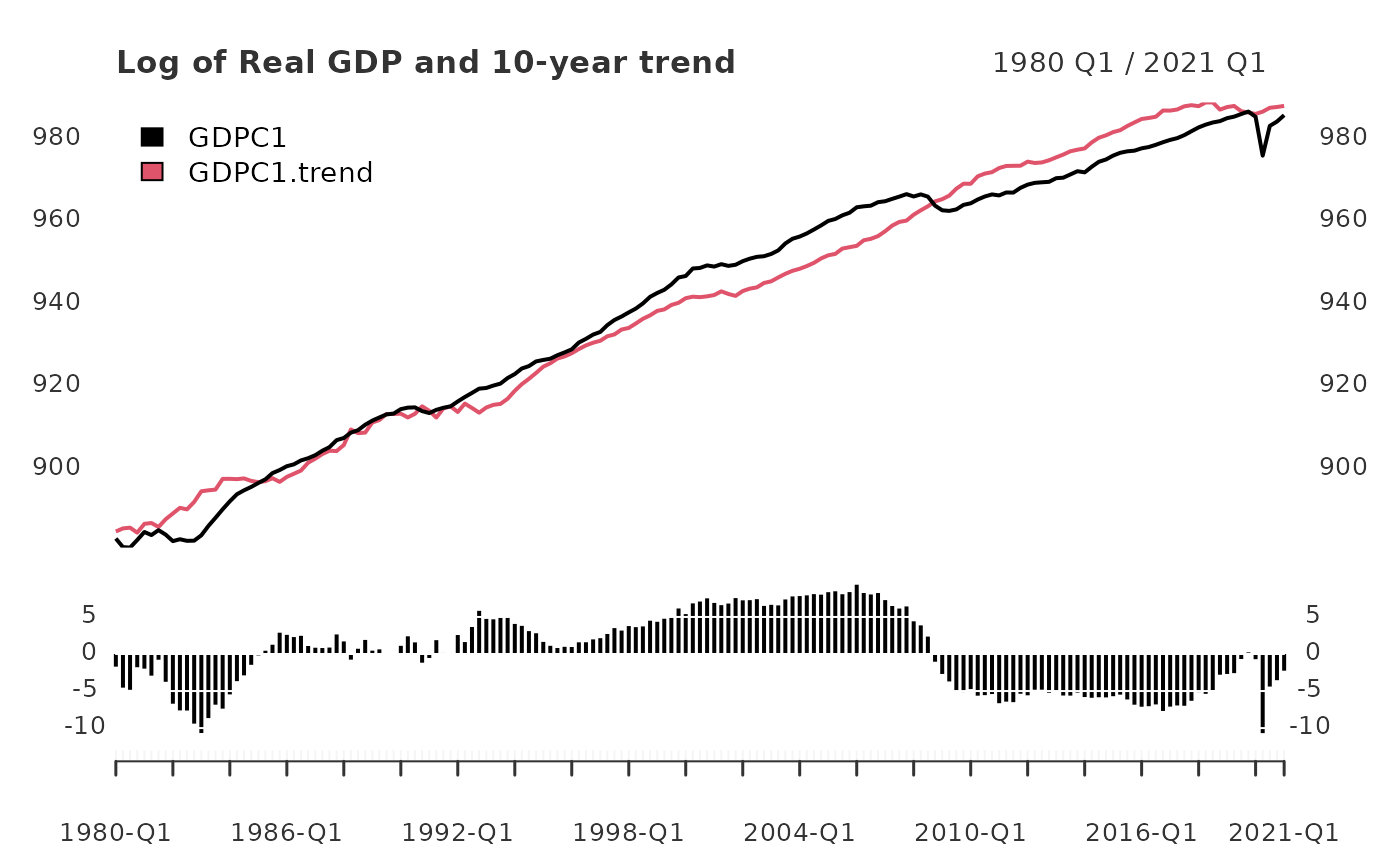

gdp_10yr <- yth_filter(log_RGDP, h = 40, p = 4, output = c("x", "trend", "cycle"))

plot(gdp_10yr["1980/"][,1:2], grid.col = "white", legend.loc = "topleft",

main = "Log of Real GDP and 10-year trend",

panels = 'lines(gdp_10yr["1980/"][,3], type="h", on=NA)')